The Drive for Automation

International moves towards automated vehicles pose a number of challenges, particularly on liability, data, cyber security and infrastructure. The drive towards automated vehicles is accelerating and concentrating minds around the globe on the associated legal, regulatory, technical and physical challenges. The end goal is for safe, fully automated vehicles and mobility solutions that can drive anywhere without the need for a driver. It is the journey there that is the real challenge.

As Matthew Avery, Director at Thatcham Research in the UK says: “There will be a mix of vehicles on our roads with different capabilities, some being driven manually, others automatically. It is vital that we make sure they can share the same road space and remain safe.”

The journey so far

So how far towards automation have we come? The US-based Society of Automotive Engineers’ Levels reflect the progress of automation, or rather the process of removing duties from the driver. Level 1 came in with the use of cruise control and lane-keep assist. Level 2, where computers take over multiple functions from the driver – and are intelligent enough to meld speed and steering systems together using multiple data sources – is where we are now in the UK.

Level 3 is conditional automation – where a driver must be on hand to respond to a request to intervene. In both Germany and France, Level 3 vehicles are now legal (since the amendment of the German Road Traffic Act in 2017 and adoption of the PACTE law in France) and can therefore be used on the road. The United Nations Economic Commission for Europe recently set up a working party that is expected to type approve Level 3 vehicles later this year, although the US and Australia do not have type approval, relying instead on self-certification. Audi calls its new A8 a Level 3 ready automated car – and it is being sold and used in Germany. However, its fully automated function, the traffic jam pilot (Staupilot) for speeds up to 60km/h, is not yet being activated due to unexpected problems in road construction.

The big step forward will be Level 4, where the driver will not really be needed in certain environments. It is anticipated that Level 4 vehicles will initially be used on motorways. This is where the likes of the Google Waymo and General Motors’ Cruise fit in, although the Tesla has also been designed to be Level 4 ready and able to convert to automated driving via aftermarket software updates.

The great advantage of Level 5 vehicles is that they will be able to operate without conventional controls, which might see the end of steering wheels altogether. This is the stage that opens up mobility to non-drivers, including the young and the elderly. Whether the utopia of a Level 5 vehicle that can operate in all driving environments can be reached remains to be seen. It may be that they are instead restricted to low-speed, confined areas such as city centres and airports.

Testing of automated vehicles is also picking up pace globally. Peter Allchorne, Partner at DAC Beachcroft in Bristol and Head of the firm’s Automated Vehicles Working Group, says: “In the UK, the next step is to enable testing on real roads without a human fallback safety driver either in the vehicle or remotely, as the Government pushes ahead to meet its set objective of a Level 4 automated vehicle being driven legally and safely in the UK by 2021.”

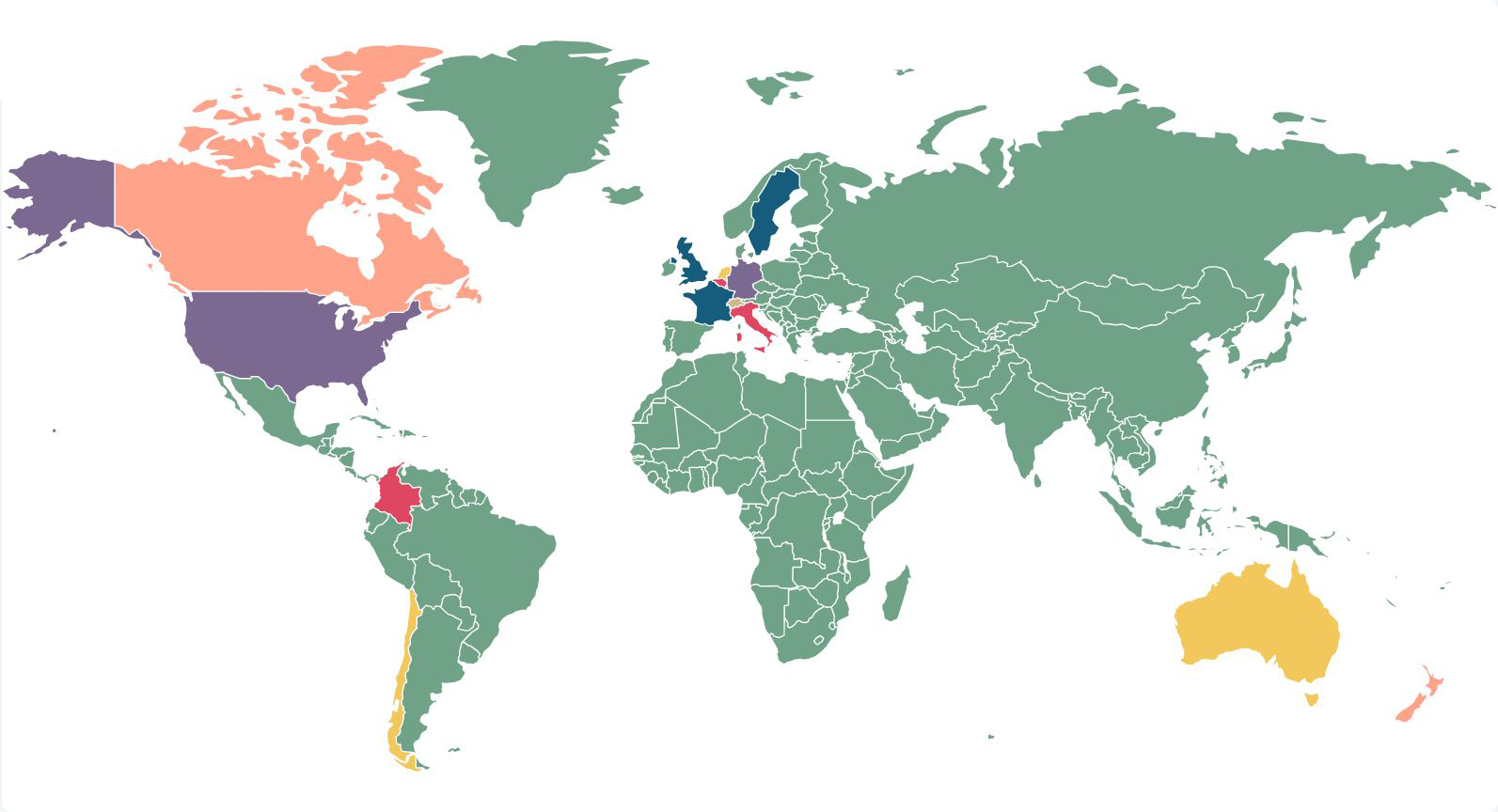

Global approach

Recent research shows that the development and use of new energy sources for transportation is a key catalyst to automation. Government support is a key influencer on prospective take up. “Scandinavia is right up there as the governments are very engaged and progressive in embracing electric vehicle readiness,” says Allchorne. “In Norway, for example, 40% of new car sales are now electric vehicles as a result of favourable tax breaks, bus lane use and free parking incentives. In the UK, buying an electric vehicle is still expensive and the infrastructure patchy. Further UK Government support for charging infrastructure as set out in the Automated and Electric Vehicles Act 2018 is vital.”

In Germany, electric car sales have been subsidised by the state since 2016. However, according to Dr Martin Alexander, Partner at Legalign firm BLD in Cologne: “Only around 134 million Euros have allegedly been distributed by way of subsidy. This corresponds to around 100,000 requests.”

According to Christophe Wucher-North, Partner at DAC Beachcroft in Paris, it is anticipated that 80-85% of new vehicles in France will have Level 2 or Level 3 automation by 2020.

In Australia, Paul Spezza, Partner at Legalign firm Wotton + Kearney in Brisbane, says that there has been no firm commitment offered by the Australian National Transport Commission to having Level 3 and 4 automated vehicles operating by a given date, largely because of ongoing differences in the legislative regimes across Australian states and territories, and concerns about the extent to which infrastructure will be available to support them.

In Japan, the authorities are also pushing hard, and want to have Level 4 automated taxis operational in Tokyo in time for the 2020 Summer Olympics. It also has a real need to embrace automation and new mobility solutions as it has one of the highest populations over 65.

So, automated vehicles are coming – but can the regulation, law and infrastructure needed keep pace and how will this play out globally? “There is a real danger”, warns Allchorne, “that different countries will take different approaches, slowing progress.”

Liability

The first priority is liability: when will the human driver be expected to respond to avert an accident and when will liability switch to the vehicle itself?

Olya Melnitchouk, Senior Associate and product liability expert at DAC Beachcroft in London says: “A safe transition to automated driving requires clear definitions and warnings to help consumers understand their own and their vehicles’ responsibilities.”

It is an important issue. A preliminary report into a fatal accident involving a Tesla Model 3 in March 2019 in the US showed that the autopilot feature had been engaged ten seconds before the crash. The driver did not appear to have his hands on the steering wheel and neither he nor the autopilot took any evasive action. In May 2016, a driver of a Tesla Model S died when his vehicle failed to spot a lorry crossing its path. The driver was found to have used autopilot for 37 minutes yet during that time he only had his hands on the steering wheel for 25 seconds. This was despite the car giving him visual warnings as well as sounding a chime to alert him to the fact that his hands needed to be on the wheel.

In Germany, Alexander explains: “In Level 3 vehicles, the driver may turn away from the traffic situation if a highly or fully automated driving function controls the vehicle. However, the driver must remain sufficiently alert that they can immediately take over the vehicle control again.” This is helpful but not clear. As Allchorne says: “Human response times are variable and the estimated average for full re-engagement is about 20 seconds.”

On this point, the UK’s Association of British Insurers insists: “Until a vehicle can handle emergency scenarios without driver intervention, they can only be considered to offer an advanced driver assistance system (ADAS). In these vehicles, drivers remain fully responsible for the car and must be ready to take back control at any moment.”

This aside, the preferred short-term insurance solution around the world for advancing automation is well illustrated by the UK’s Automated and Electric Vehicles Act 2018. It extends compulsory motor coverage to driverless vehicles – so that in an accident, the insurer pays out and can then pursue the supply chain using existing common law and product liability laws should the driver not be at fault. Insurers would be able to limit their liability, for example, if the automated driving system (ADS) was tampered with by the insured, or if updates to the ADS were not installed or updated by the insured. The 2018 Act will not, however, apply until relevant vehicles are on the road.

The European Union has reviewed the scope of the Motor Insurance Directive and the Product Liability Directive and no changes were considered necessary for automated vehicles. Automated vehicles will be required to have third-party liability insurance in line with the Directive. The insurer can take legal action against a manufacturer under the Product Liability Directive if there is a malfunction or defect in the ADS. It is also possible that claims could be brought for negligence or breach of contract.

One issue that remains uncertain is whether a product, as defined in the Product Liability Directive, would include an over-the-air update which is purely software and not incorporated within a physical medium. The European Commission has established an Expert Group on liability and new technologies to consider such questions and develop principles which can serve as guidelines for possible adaptations of applicable laws at EU and national level relating to technologies such as automated cars.

Data

The General Data Protection Regulation (GDPR), which came into force on 25 May 2018, has enhanced an individual’s data privacy rights. Any processing and sharing of personal data which is collected by automated vehicles will need to comply with the various obligations set out in the GDPR. Failure to do so could result in significant fines (of up to 4% of annual global turnover or 20 million Euros, whichever is the higher) or enforcement action such as orders to stop processing personal data.

In Germany, comments Alexander, the 2017 Road Traffic Act (Straßenverkehrsgesetz) stipulates certain data must be recorded anonymously if a highly-automated driving function takes over control of a vehicle and that authorities and third parties can apply for access to it in the event of an accident. Insurer Allianz has proposed the data must be handled by an independent trustee from whom the manufacturer and insurer can request information in future.

The French data protection authority (CNIL) has also issued a package of compliance guidelines for personal data from connected vehicles but according to Wucher-North, the CNIL is yet to address in more detail the future needs of data sharing.

According to Spezza, the Australian National Transport Commission is following the German approach on the issues of privacy and cyber security. He says that the collection, use and disclosure of personal information by entities involved in the roll out of ADS will likely be governed by the Commonwealth Privacy Act rather than the legislative regimes dealing with privacy in the states and territories. Spezza notes: “On a broader level, there are still some doubts as to whether the existing legislation adequately deals with the risks of government access to automated vehicle data.”

Whatever the legal framework countries adopt, one thing is sure: insurers, manufacturers and the authorities will need to have an agreed minimum post-collision data set sharing arrangement in place – with appropriate contractual provisions on data protection – with those who process any personal data. This is not as simple as it may sound and it still needs to be clearly established what data sets will need to be shared between the parties in the event of an accident.

In the UK, the legal issues are being looked at by the Law Commission. Crucially, it excludes data, cyber security and infrastructure from its remit. It has, however, mooted some relevant questions that it believes need to be addressed:

- Should there be a road accident investigation branch to consider high-profile road accidents (including those involving driving automation)? An advantage of this is that it could develop high levels of technical expertise and pool data over many individual incidents, however, this would involve potential data sharing implications that would need to be considered.

- Are there any potential problems in retaining data for long periods of time to deal with possible claims under the Automated and Electric Vehicles Act 2018?

- Should developers disclose their ethics policies?

But there are wider issues, flags Shehana Cameron-Perara, a data protection and cyber specialist at DAC Beachcroft in London: “Another significant data issue relates to the broader use and ownership of the much richer data set that will be collected by the vehicles on an ongoing basis. Beyond the value to insurers for pricing and underwriting, this data is also of real commercial value to any marketing-orientated organisation.” As Allchorne adds: “If drivers see real benefits from sharing their data, such as receiving timely discounts and savings via the in-car infotainment screen, then they may be happy to share their data.”

Cyber security

“The move to interconnected cars that talk to each other in real time under Level 4 and the potentially large amounts of data that may be collected by automated vehicles also ups the stakes in terms of increased vulnerability to hacking and cyber-attacks. Ultimately, as technology advances, more useful data will be collected, which will consequently become more attractive to hackers or could result in threats from terrorist or criminal activity,” advises Cameron-Perera.

The European Commission consulted on the issue of data and cyber security at the end of 2018, but at the time of writing the results have not been published. The expected approach is one of security by design, transparency over use of personal data, board-level accountability and requirements to keep abreast of the whole supply chain to stop any weak links. That final point is critical as security is only as good as the weakest link when transferring data. A requirement for software patches and updates to be rolled out by vehicle manufacturers – and infrastructure providers – in a timely manner is also likely to be included, learning from problems experienced recently in the airline industry.

Infrastructure

Infrastructure is another internationally and regionally variable factor – and one susceptible to power surges, outages, hacking, everyday wear and tear and lack of maintenance.

“The sheer scale of Australia against what is a relatively small population, the majority of which is concentrated in the south-east corner of the country, will present challenges from an infrastructure and technology perspective,” says Spezza. “Australia has approximately 900,000 kilometres of roads – over half of which are unsealed and unmarked. The inconsistencies among urban, regional and country roads and how they interface with digital infrastructure, such as mapping and communications, will necessarily require considered and co-ordinated management by the Federal Government.”

One issue is that dynamic electronic signs and LED signs do not necessarily have the same level of functionality as that seen in Europe. “Australia’s geographic coverage of cellular communication is also relatively low when compared with other developed countries, particularly outside urban areas. We have seen examples of motor vehicle manufacturers withholding particular safety applications in vehicles because of limitations in our infrastructure network,” adds Spezza.

The lack of basic white lines and patchy 4G network coverage is an issue in the UK – especially as the Government plans to work with the existing infrastructure to meet its 2021 target.

Network coverage across the rest of Europe is generally better than in the UK, and the motorway networks also have longer stretches of road than the UK, making vehicle platooning – which can reduce stop-start traffic, lowering emissions and costs – more achievable.

The US, which is ripe for vehicle platooning, should, in theory, be streets ahead in terms of early adoption. However, while the Federal Government is responsible for regulating the safety performance of vehicles, Frank Manchisi, Partner at Legalign firm Wilson Elser in New York, says states and local governments regulate the licensing of drivers, establish the rules of the road and formulate policy on tort liability and insurance. In seeking a solution, Manchisi says, the National Highway Traffic Safety Administration (NHTSA) is pushing for uniformity and urging states and localities to work to remove barriers such as unnecessary and incompatible regulations to automated vehicle technologies and to support interoperability.

Australia has a similar issue, says Spezza, with an estimated 716 pieces of federal, state and territory legislation requiring amendment. “In November 2018, Australian state and territory transport ministers agreed to remove barriers to automated vehicles in Australia with the development of a purpose-built national law,” says Spezza. He further notes that those ministers endorsed the safety assurance approach of automated vehicles including mandatory self-certification by the company bringing the technology to market and a clear set of performance-based safety criteria against which companies must provide evidence.

The impact on insurance

Safety has been the main driver in the push for automated vehicles – and it is easy to see why. According to the World Health Organisation, around 1.35 million people die on the roads each year and 95% of all road traffic accidents are caused by human error. Advances in ADAS are already helping to reduce the amount, and cost, of personal injury and it has been estimated that automation could reduce insurance premiums by 75%, especially if liability is shifted from drivers to manufacturers and technology companies.

However, as Allchorne explains: “The cost of physical repairs is also set to rocket as innocuous bumps and scrapes cost thousands to repair, with complex and intelligent headlights and bumpers. Perhaps, ironically, this will drive insurance underwriters to focus more on the vehicle itself, rather than the driver, much sooner than the switch to full automation would entail.”

Consumer collaboration

A further consideration for manufacturers is consumer acceptance and education. While public confidence varies in different jurisdictions, there remains both distrust and a lack of understanding generally. For example, the labelling of Tesla’s current Level 2 driver assistance system as ‘Autopilot’ is not helpful as it implies the vehicle is capable of driving itself when it is not, Allchorne warns.

In the final analysis, the pace of change will be dependent on industry collaboration with consumers. As Allchorne advises: “If automated vehicles are to achieve mass market penetration, industry stakeholders must keep consumers at the forefront of their minds as they bring to market increasingly sophisticated new vehicle technologies.”

What is happening at sea?

The testing of automated crewless craft is underway on a limited scale, but is increasing says Toby Vallance, Partner at DAC Beachcroft in London. One example is Finferries’ Falco, developed with Rolls Royce, which navigated a distance of 1.5 miles in Finland under full autonomous control, with the return journey conducted under remote control. It is notable that unlike with automated road vehicles, remote controlled ships (with or without crew) will form part of Maritime Autonomous Surface Ship development. And in Norway, testing of the Yara Birkeland, an automated fully electric zero-emission container vessel operated by fertiliser company Yara, is aiming to be in full operation by 2020.

These developments have helped to focus the mind of the regulator, the International Maritime Organisation (IMO), says Vallance, and its maritime safety committee is looking at how crewless vessels could work in practice. The IMO is also reviewing the Safety of Life at Sea regulations, which currently require crews on board; and the existing collision regulations.

As the reliance on technology increases, the IMO is also looking at liability and cyber issues, such as an automated engine management system being hacked and shut down. GPS-spoofing is also on the increase, including recent incidents involving the South Korean fishing fleet and the US Navy.

Investment is being driven by economics and the cost savings from removal of crew quarters, crew pay and overall efficiency. “We will see more vessels being tested on a coastal basis and, over the next five years, remote control shoreside vessel management and improved regulation,” says Vallance. “However, we are looking at 2030 and beyond before we see regular deployment of fully automated ocean-going vessels due to the conservative nature of the maritime sector and the entrenched seafaring lifestyle.”

The rise of drones

“Drones continue to make inroads in both the leisure and commercial spheres, with a major uptick in the latter,” says Stephen Turner, Legal Director at DAC Beachcroft in London, “especially in construction, offshore energy, agriculture, and insurance underwriting and claims.”

Growth in urban environments is limited with the issues of congestion, safety and interference perfectly illustrated by incidents around London Gatwick and Dubai International airports. While improved geo-fencing helps, it can only do so much as individual drone owners also need to upgrade their software and adapted or hacked drones can – and will – circumvent any security.

The established aviation sector provides the obvious framework for regulation and standards, and the EU is working with the international aviation regulator. The direction of travel is clear; the Civil Aviation Authority in the UK will, for example, introduce increased certification and training requirements for drone operators in November 2019, while new EU-wide rules on the use of drones have been published and will be in force from 2020.

“The onus will be placed on manufacturers to build in cyber and data security features. However, emphasis is also shifting towards the operator,” summarises Turner, “with the need for pilots to be registered, certified and trained.”

Privacy issues are also on regulators’ minds, as many drones have cameras fitted – raising concerns over how data and information collected is shared. In the UK, guidance from the Information Commissioner’s Office relies on the existing pre-GDPR CCTV code of practice for commercial users. However, in Spain, the Government plans to create guides for manufacturers on processing data and the protection of communications, says Pilar Rodriguez Lopez, Partner at DAC Beachcroft in Madrid. Training centres will also be created for operators and measures put in place for the control and inspection of operations.