The US space agency NASA says the nine years leading up to 2023 have been the hottest since records were first taken in 1880 but it is not just temperatures that are increasing. The number of climate change- related court cases has shot up over a similar period, with the London School of Economics (LSE) reporting case numbers doubling globally between 2015 and 2022. The pace of change is also increasing, with roughly a quarter of these cases being filed between 2020 and 2022.

Climate change litigation may be increasing rapidly but according to Sarah Crowther, London-based partner at DAC Beachcroft, there are clear trends emerging.

In another action initiated by young people - another trend in itself - a climate action was brought in Held and others v Montana against the State of Montana, alleging a breach of their constitutional rights to a “clean and healthful environment in Montana for present and future generations”. The trial concluded in June 2023 and judgment has just been given in favour of the Plaintiffs, although an appeal is expected.

Another trend is activist litigation against companies. This is exemplified by the Dutch case of Milieudefensie and others v Royal Dutch Shell plc. This action sought a ruling that the company had a duty of care to reduce carbon emissions in line with the 2015 Paris Agreement under the Dutch Civil Code and European Convention on Human Rights. The Hague District Court ordered a reduction in Shell’s emissions, which is being appealed. If upheld, it offers a blueprint for prospective actions against other companies seen as contributing to carbon emissions, building on the landmark Urgenda v Netherlands decision against the Dutch government.

An attempt in the UK to extend this litigation against companies to target directors personally has recently been brought in ClientEarth v Shell plc and others. The claim alleges breaches of the directors’ statutory duties by failing to adopt an energy transition strategy that properly manages the risks posed to the company by climate change. Permission to bring such a derivative action was initially dismissed by the High Court earlier this year at a paper hearing, and this was subsequently upheld following reconsideration at an oral hearing.

Focus on France

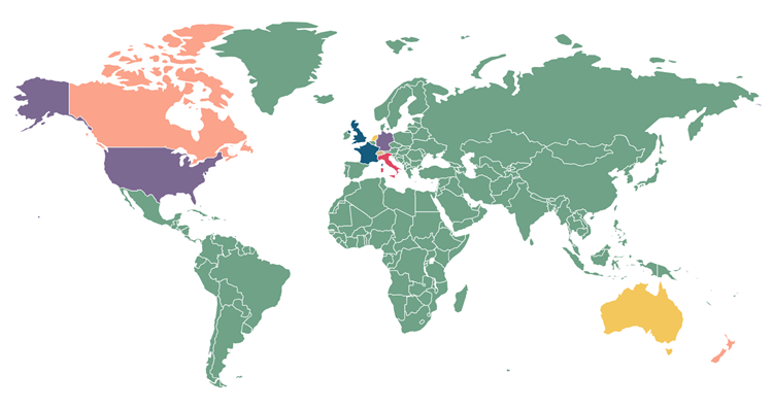

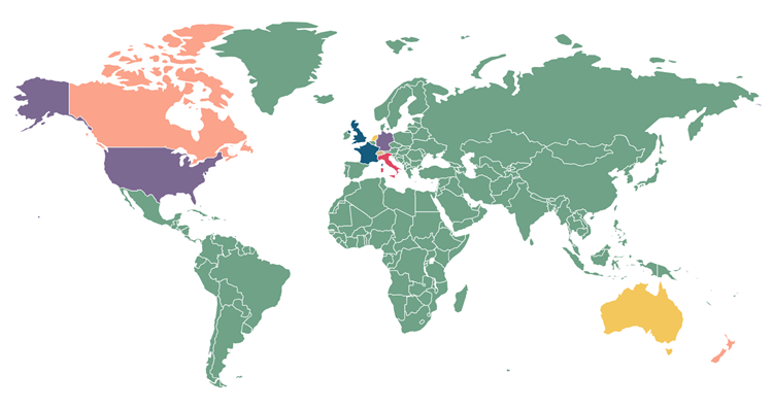

In DAC Beachcroft’s selection of their top 20 active climate change litigation cases to watch (see map), the highest concentration is in France, including Greenpeace France’s allegations that Total Energies has engaged in greenwashing, and French NGO Notre Affaire’s action against the bank, BNP Paribas.

The case against Europe’s largest bank is being brought under the French Corporate Duty of Vigilance Law. This legislation requires firms over a certain size to identify risks and prevent human rights abuses or environmental harm from their actions. DACB’s Paris-based partner, Vladimir Rostan d’Ancezune, says the statute provides a useful framework for climate change litigation against corporates.

“Overall, the law establishes a comprehensive framework that facilitates legal action by NGOs against private companies,” says d’Ancezune.

According to him, the potential for climate change litigation is set to increase in France and across the whole of the European Union as part of the Fit for 55 initiative.

He says the framework set out by the trading bloc to become carbon neutral by the middle of this century will bring a variety of legal challenges and a rise in the potential for climate change-linked litigation.

“Environmental organisations and concerned citizens might take legal action against governments or corporations that fail to implement and enforce the necessary measures to achieve the targets. Conversely, companies or industries adversely affected by these policies might challenge the legitimacy or feasibility of the targets, seeking relief or exemptions,” he says.

He also points to the expansion of the EU Emissions Trading System (ETS) to include sectors such as building, and maritime and road transport, as a potential trigger for legal action.

“Industries impacted by these changes may contest the fairness or legality of their inclusion in the ETS, potentially leading to litigation,” says d’Ancezune.

Click here to view DAC Beachcroft’s top 20 active climate change litigation cases to watch.

Beyond damages

Research published by the LSE in May this year says unfavourable judgments in climate change cases involving the largest emitters - typically energy, utility or materials firms – have driven a 1.5% fall in their stock price. According to Crowther, it is not just a financial impact that activist investors pose to corporates.

In the Milieudefensie and others v Royal Dutch Shell plc litigation, led by several environmental NGOs and backed by 17000 Dutch citizens, The Hague District Court ruled that the oil and gas major must reduce its CO2 emissions by 45% compared to 2019 levels by 2030 in order to bring it into line with the Paris Agreement.

“For insurers, climate activist litigation is very difficult because the plaintiffs are not seeking damages or looking for a financial outcome. And when plaintiffs are saying, for example, ‘We want you to reduce your CO2 emissions’, that might be incompatible with the company’s business needs,” she says.

Crowther says climate change litigation of this type may require not just a different settlement strategy but also a change in how insurers underwrite these risks.

“When insurers are underwriting defence costs they are prepared to pay damages, but they are not going to reimburse the company for any loss it might suffer as a result of any steps it needs to take to become more environmentally friendly. So, we might see a slight shift in underwriting appetite,” she says.

According to Guido Foglia, a partner in DACB’s Rome office, this change in underwriting appetite could itself have the impact on firms’ industrial strategy which activists are seeking through the courts.

Greenpeace Italy’s action against oil and gas firm Eni is the first climate change case of its kind in the country. The action pits 12 Italian citizens, backed by NGOs ReCommon and Greenpeace Italy, against the state-owned hydrocarbon producer, and is again linked to the Paris Agreement.

Foglia says there is still a screen of uncertainty around the case in Italy but that it is logical to assume it will prompt a change in how insurers underwrite risks in future, which in turn could affect corporate policy.

“Insurers have an interest in reducing the amount of risk that is passed onto the insurance market and the two main tools the industry has are increased premiums and reduced coverage,” says Foglia.

“If companies know that they have to face these damages without having their shoulders covered by insurance, they could be forced to review their industrial strategy,” he adds.

Impact on D&O insurance

Another potential change in underwriting practice could see climate change carved out as a standalone insurable risk, similar to cyber. The recent ClientEarth derivative action against Shell was the first time directors in the UK have been specifically targeted by activists and is likely to prompt a review of how directors and officers (D&O) insurance is viewed by underwriters.

Typically, D&O insurance is not intended as a blanket general liability coverage and d’Ancezune says it is likely firms will need to obtain additional coverage for defence costs incurred by insured individuals due to non-compliance with environmental legislation.

This issue is further complicated by existing – and, so far, untested in court - exclusions for pollution from many existing D&O policies.

“D&O insurance will need to change in the future, at least in order to cover defence costs incurred by directors and officers due to climate change litigation,” says d’Ancezune.

Climate change litigation in Asia Pac: the other end of the spectrum

Europe may be facing a build-up in climate change litigation but the picture in Asia Pacific is very different, according to Singapore-based DACB partner Andrew Robinson.

Robinson contrasts the more than 120 climate change linked pieces of litigation that are currently ongoing in Australia with the roughly 20 sprinkled across the rest of Asia Pacific. Twelve of these cases are in Indonesia, and all but two of them are long running actions by government entities against illegal logging or palm oil producers, some going back as far as 2012.

“Australia is ahead of the curve in Asia Pacific when it comes to climate change litigation but it currently occupies considerably less attention in the rest of the region,” he says.

Robinson says the level of climate change litigation in Asia is likely to remain muted, largely due to the minimal presence of key legal and social building blocks and pressure groups which have been the drivers of much activity in this area in Australia, Europe and North America.

“Globally, climate law tends to stem from existing environmental legislation which has never been particularly well-established or stress-tested in many Asian jurisdictions. Also, in certain heavily government-controlled Asian countries, the likes of individuals or activist groups may have limited opportunity to challenge the state,” he says.

Robinson expects that meaningful movement on climate change in Asia will be accelerated by the interests of multinational corporates and the possibility of large firms focusing the growth of their regional facilities on those states which are more ESG aware / compliant than others.

“Increasingly, global firms with interests in Asia Pacific, mindful of their responsibilities to their shareholders and stakeholders, will be adjusting their business strategies by taking into account whether the target (be it an initial growth, a merger, an acquisition or even the country itself) is aligned with their own ESG philosophies.”

South Africa set for more environmental court cases

The World Bank rates South Africa as “especially vulnerable” to climate change due to issues of water and food insecurity. David Geral, partner in financial sector regulation at African law firm Bowmans, says climate change litigation in South Africa has so far focused on pollution, and specifically on governmental failure to promulgate or enforce domestic emissions laws.

Activist groups have successfully achieved declarations of unconstitutional conduct and mandatory orders (compelling legislative action) on the grounds that governmental inaction breaches citizens’ constitutional right to “an environment that is not harmful….and is protected for the benefit of present and future generations”. The most recent case is currently under appeal, although the promised air standards regulations have not yet appeared.

At the end of 2020 the Environment Ministry had to roll back plans for a 557 MW coal-fired power plant after losing a legal action first brought by environmental group Earthlife Africa in 2017, and in which the United Nations Special Rapporteur on Human Rights and the Environment participated as amicus curiae (friend of the court).

According to Geral, there are set to be more environmentally-linked court cases in South Africa, with the recent decision to lift a moratorium on shale gas fracking likely to lead to further litigation.