Chapter 4: ESG: Creating Sustainable Value

People, Planet, Profit: How to Marry Purpose and Value in the Pursuit of Sustainability

The ESG agenda is one of the overarching corporate strategies of 2023, despite the wider economic and political uncertainty. Many firms talk about it but what does real commitment to an integrated ESG strategy look like? The key word is ‘integrated’.

There is a growing realisation that you cannot run disconnected Environmental, Social and Governance strategies. The three areas are interlinked and mutually dependent on each other. For many firms this means drawing them closer together under the banner of sustainability. This is much bigger than just the E as it embraces the need to support communities. It also brings compliance and governance to the fore, as regulators, directors and shareholders are asking harder questions about preparedness to cope with the impacts of climate change and raising expectations about achieving genuine gender equality and promoting diversity.

True integration across all aspects of ESG is now seen as essential to enhancing longer-term value, broadening the concept of sustainability still further.

The impact of this change is being felt right across the complex insurance supply chain, says Helen Faulkner, Head of Insurance at DAC Beachcroft:

“It is now standard in every tender that clients ask about sustainability and net zero. It is also the same on diversity. They want to see real substance to what we are doing.”

This means putting your own house in order first, says Faulkner:

“Law firms are naturally quite siloed but ESG sits across the traditional practice areas so it has to be a board level strategy, owned and led from the top. This is recognised in Our Purpose which is “to help our clients and our colleagues succeed, creating sustainable value”. The challenge of getting it embedded across large, diverse and complex organisations should not be under-estimated.”

There will be no hiding place from this more intense scrutiny, says Lois Duguid, Head of ESG at DAC Beachcroft:

“The world has not stood still over the last year. The demands of our clients and the marketplace have moved and they continue to move on rapidly. We have come under increasing pressure from clients for better data, as we are in their value chain. This is the big change as people realise that a lot depends on their own suppliers and their suppliers’ suppliers.”

Staff are a key part of the drive to find value in sustainability

It is not only clients who are exerting pressure on businesses to become more sustainable, contributing meaningfully to the drive to net zero, says Duguid. It is now coming from staff and is a growing factor in the war for talent, a crucial factor in building sustainability.

“A recent report from Deloitte highlighted how Gen Z and millennials are demanding more from employers on ESG. It showed that as many as one-in-six have changed jobs because of climate concerns. Concern about an employer’s action on climate is now cited by some as a wellbeing issue which shows just how far ESG leaks into all sorts of other buckets.”

The potential for this to grow into a major issue for the insurance industry should not be under-estimated, she says. The reputation of the industry hangs in the balance when it comes to climate change, especially because of its relationships with the big energy producers and other high carbon emitters. The industry can have a positive story to tell but it has to find its voice.

“Finance, banking and insurance are part of the global economic architecture that you cannot do business without and that is where the opportunity to build the right sort of reputation lies. Insurance is essential to enabling the transition to a green economy.

Big energy has the biggest interest in developing green solutions and is going to plough enormous amounts of investment into research and development to deliver its commitments to net zero.

It needs insurers to support the innovation that comes from that.”

The ESG vision is not shared by everyone

This is not, however, universally accepted.

As businesses turn the fine words about ESG into a deliverable and measurable reality so they have run into opposition, mostly coming from right-wing climate change deniers. Nowhere has this been felt more than by the insurance industry and wider financial services sector in the United States.

The much-heralded Net Zero Insurance Alliance (NZIA) is now struggling as major insurers, reinsurers and Lloyd’s made a public exit when 23 US state attorney generals rattled their collective sabres by threatening to take action against the members of the NZIA under US competition law. The reasons cited by the Republican lawmakers contain many of the objections to tackling the impacts of climate change bandied about by American climate change sceptics and which have contributed to the growing momentum of the wider anti-ESG movement in the States.

The letter sent to members of the NZIA by the attorney generals accuses insurers of advancing an “activist climate agenda” and that the pressure it is putting on fossil fuel interests is contributing to inflation: “The push to force insurance companies and their clients to rapidly reduce their emissions has led not only to increased insurance costs, but also to high gas prices and higher costs for products and services across the board, resulting in record-breaking inflation and financial hardships for the residents of our states.”

The exodus from the NZIA contains some of the biggest names in global insurance: Swiss Re, Munich Re, Allianz, SCOR, Mapfre, QBE, Sompo, Zurich, AXA and Lloyd’s. Out of the impressive cast of major European insurers that set up the Alliance only Aviva and Generali are left, neither of which has significant business in the US.

Aviva CEO Amanda Blanc says Aviva is standing firm and urged the industry to find ways of working together. As she told a recent Association of British Insurers’ conference:

“Political headwinds are temporary. They don’t last forever. But if we don’t act, catastrophic climate change will be the norm, and like political posturing, climate change will be permanent if we don’t act together to tackle it.”

The irony is that the United States is seeing the biggest increase in climate-related litigation (see our separate thought leadership piece on climate change litigation risk).

More than climate change

Making a business resilient in these turbulent and fast-changing times is about more than just focusing on climate change. Equity, diversity and inclusion, regulatory change, geopolitical instability on a scale not experienced for a generation, and artificial intelligence are all forcing their way onto boardroom agendas.

When it comes to diversity, Faulkner says the conversations are more nuanced and moving at different speeds:

“There are some excellent initiatives that we have been supporting around mentoring and career progression.

“In our individual offices too, we have been looking at the ethnic and class mix of our colleagues and creating a road map for addressing the inevitable imbalances. It is another way of building long-term value into a business, and mutually beneficial value: value for the community and value for the business that unlocks fresh talent.”

Thrown into this already broad and daunting mix of issues, fundamental to the future of insurance – indeed business as a whole – is artificial intelligence. A year ago it was a fringe issue, almost confined to the world of big data computing. Now, it is everywhere: in every conversation about the future of technology, the future of work, the future of politics and, for some, even the future of humankind.

Many point to the legal world as one most ripe for disruption by AI. Faulkner acknowledges that potential disruptive power: “It is definitely exercising us but we want to work with it, harnessing its obvious capabilities but with appropriate caution while this very young technology continues to develop. We also firmly believe in the contribution of our colleagues, both in terms of handling higher-order tasks and bringing vital emotional intelligence to client advice.”

Finding the answers

No one business has all the answers, says Faulkner.

DAC Beachcroft has been working alongside a specialist group of consultants, Stories Evolved: a global ESG and sustainability consultancy led by a team of internationally experienced lawyers and educators. Stories Evolved focuses on the intersection of resilient and responsible business and ESG impact. Together they have identified the G of Governance as the key element in delivering and implementing effective ESG strategies, a first among equals.

“The G is the glue that binds the E and the S together”, says Stories Evolved co- founder Christina Bartholomew. “It is the by-word for strategy and process, the crucial mechanisms that must be harnessed to deliver what would otherwise stay as top-level statements of intent, rather than programmes of action and impact.

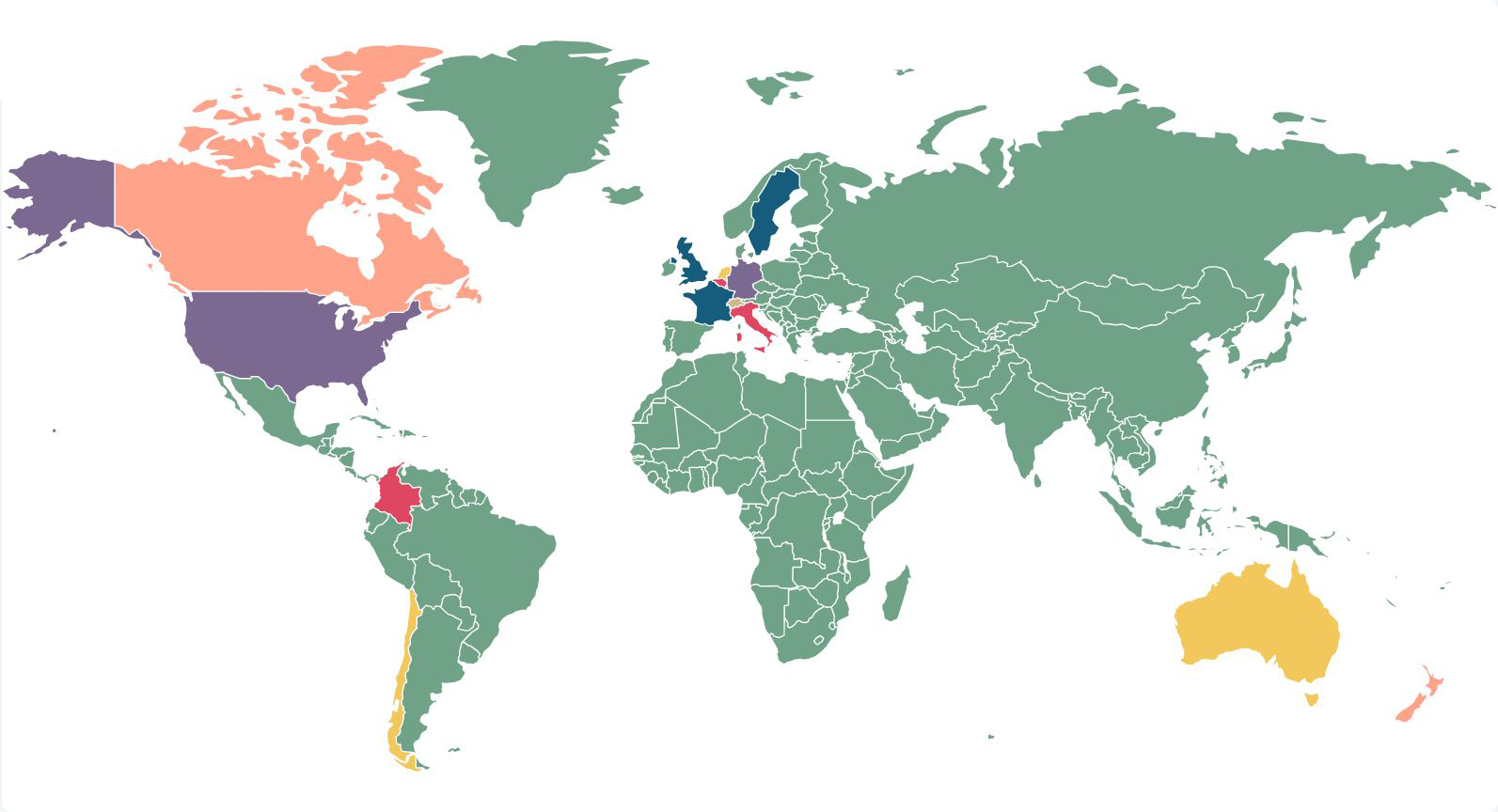

“It is not that we doubt the sincerity of the ambition, but the challenge of turning that ambition into tangible action is what defeats so many firms. A recent IBM survey of 3,000 CEOs of major businesses from over 40 countries found that although ESG was at the top of their agendas, turning their ambitions and commitments into measurable results was a consistent theme.”

She acknowledges that facing all the issues that have now gathered under the ESG umbrella is daunting: “The project is such a profoundly big one that it requires a complete rewiring of business. It is about disruption and it is about transition, but this transition must be a just one.”

A failure to place justice and fairness alongside the business objectives will be dislocating for society: “Just look at what has happened in the United States. You get people who feel disenfranchised, which paves the way for populist leaders to emerge.

“I think that this challenge can lead to paralysis. If we do the transition badly, we will create a new set of problems.”

Bartholomew talks about taking a long-term view and working alongside the communities likely to be most severely impacted by unstoppable disruptive change, such as those dependent on the huge fossil fuel industries and those experiencing insurance protection gaps.

“It is essential to look at this through a long-term lens. Let’s start talking early about the opportunities to revitalise these communities with investment in a product that people really want – clean energy.

“No-one is pretending this is easy. It is a massive task. You win in one area but you may lose in another. The key is developing solutions to mitigate those losses.”

The insurance industry will be central to this process, says Bartholomew, and if it fails to accept that role its own future will be threatened.

“The insurance industry is deeply embedded in everything that goes on in the economy so it can be a powerful enabler and supporter of the just transition. If it isn’t then its future does not look good. The impacts of climate change mean that it is already paying out record sums globally. It is an unsustainable business model.”

There is no time to delay

There is no time to delay, she warns, as the expectations placed on the insurance sector will continue to mount up – and they will come from many directions.

She agrees that key ESG issues beyond climate change litigation coming to the fore in the months ahead include biodiversity, geopolitical risks and the digital revolution.

“The Task Force on Climate-related Financial Disclosures was the blueprint for the implementation of ESG-related disclosures. These took six years to become mandatory in the UK. The Taskforce on Nature-related Financial Disclosures will likely go from voluntary to mandatory in half that time”, placing major client sectors such as construction on the front line in the battle to save one million species from extinction: “Insurance underwriters’ response will be absolutely crucial”.

Across the entire ESG spectrum, gauntlets are being thrown down. Only an integrated response will deliver that crucial marriage between profit and sustainability - and with it, survival for the insurance industry.