The scale, scope and connectivity of the major disruptive threats to the global insurance industry have come into even sharper focus over the last year as the COVID-19 pandemic maintained its grip on the world.

Our scenario planning research last year mapped the major critical certainties and uncertainties and showed how deeply inter-connected they are. The pandemic has further highlighted how they cannot be ignored or siloed. As the months of emergency lockdown dragged on, social unrest swept through the streets of major cities, especially when the Black Lives Matter movement attracted huge numbers of new supporters following the death of George Floyd. With households fighting to survive financially, there is now a greater exposure to cyber risks and need to safeguard privacy as staff work from home, moving critical data around poorly protected networks. Even as the economy starts to recover, the impact of Brexit will continue to challenge international co-operation and the integrity of the United Kingdom. And as the rebuilding and restructuring begins, focus can return to climate change and its connection to extreme natural catastrophes and energy resources, climate change providing yet another source of protest and unrest.

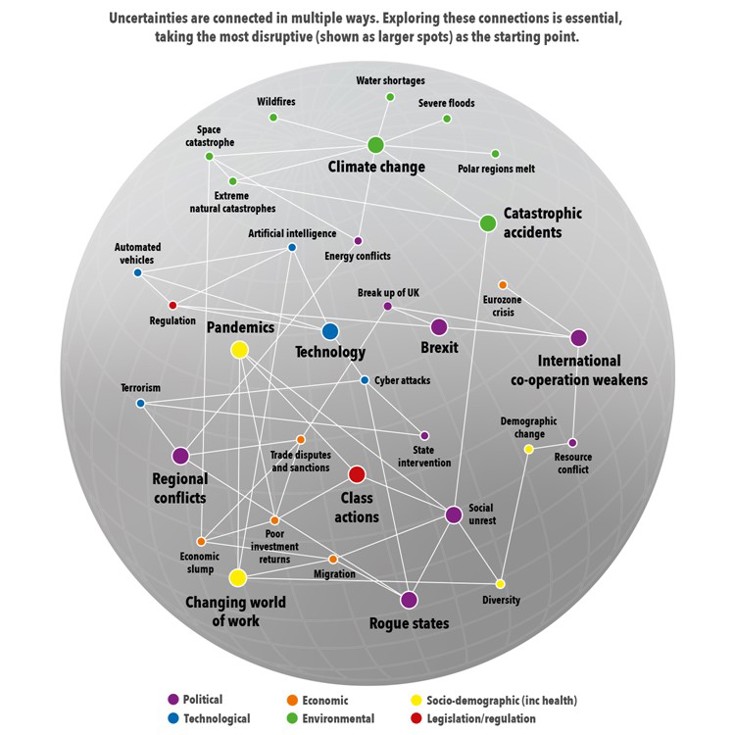

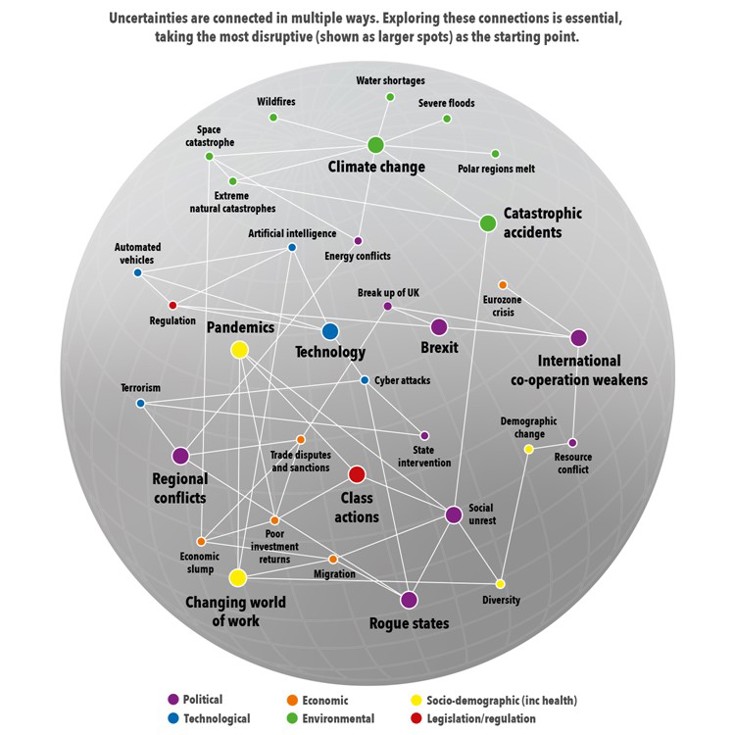

Fig 1: The interconnectivity of uncertainties

The heightened awareness of these interconnected risks on the insurance industry is also the key theme of a June 2021 research report from the Geneva Association, The global risk landscape after COVID-19: What role for insurance? Using similar scenario mapping techniques to our own, it analyses the key risks and groups them under four main headings: Accelerated Digitalisation, Remote Working, Big Government and Sustainability; with inequality, rising populism and the consolidation of economic power all bubbling just below the surface.

The interconnectivity of solutions

Wherever you look, these disruptive uncertainties are connected. If the challenges and threats to insurers are connected, so must be the solutions. For an industry that is often identified by its own leading figures as being siloed, this will require radical fresh thinking.

The search for solutions will not just be a quest for greater connectivity – perhaps seen as a rather academic exercise by some – but a battle to stay relevant in the face of systemic risks that look to be beyond the scope of traditional insurance solutions.

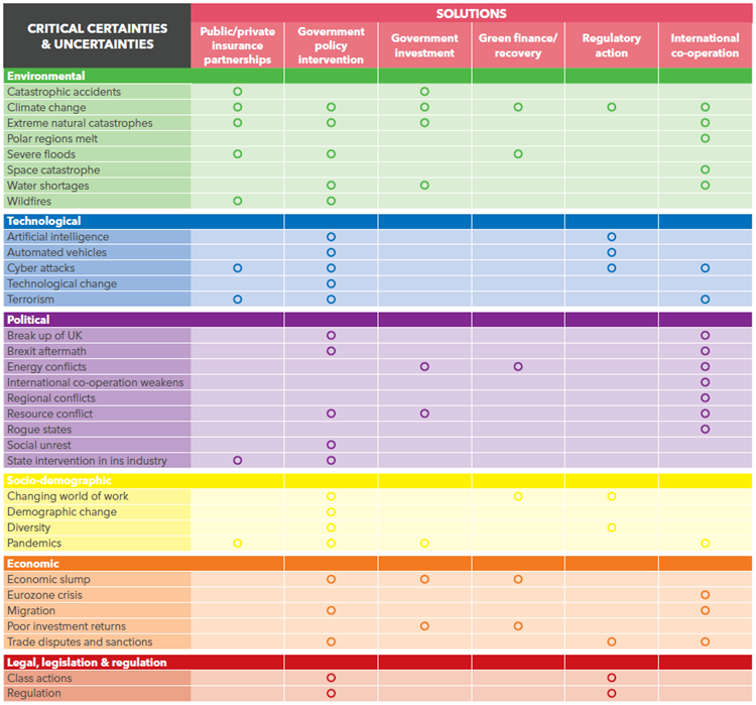

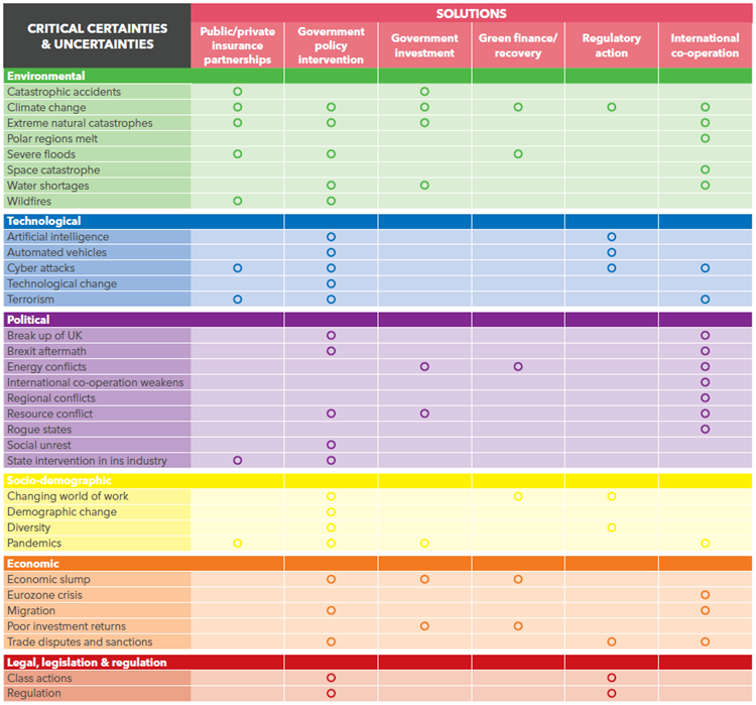

Fig 2: Possible thematic solutions to critical uncertainties

To illustrate the connection in solutions, the global uncertainties above are charted against possible categories of intervention. While not definitive, this is intended to help firms identify where to focus their efforts most effectively in the search for operational and financial resilience.

Mind the (protection) gap

All governments have plunged their economies deep into debt in order to mitigate the economic hardships created by the pandemic; but in so doing, they have exposed the gaps between private sector insurance-led solutions and public provision. No-one is suggesting that insurers could have responded to protect individuals and livelihoods in the way governments have, but the pandemic has cast government in the role of insurer of first resort in the eyes of many.

The insurance industry needs to be at the heart of the debate about how sophisticated economies facing major risks and new disruptive threats respond, says former Cabinet minister Lord Hunt of Wirral, a Partner at DAC Beachcroft and Chairman of its Financial Services Division.

“It very quickly became clear that it was impossible to insure against the full impact of the pandemic and that remains a major challenge. The scale of government intervention far exceeds the scope of what the insurance industry could do and it is still being asked to do more. There are still serious gaps in many areas.

“If there is a positive partnership between the public sector and the insurance industry then we can find ways of bridging those gaps, as we have done before with terrorism and flooding.”

New risks

The list of systemic risks beyond the scope of traditional insurance solutions grows longer all the time, says Helen Faulkner, Head of Insurance at DAC Beachcroft.

“The impact of climate change is potentially huge and still largely unknown. Insurers are collaborating on facing up to climate change through organisations such as ClimateWise. We are proud to have become the first law firm to join this alliance of over 35 global insurance organisations committed to reducing the impact of climate change on society. It has done some really good work on identifying the main risks and what insurance will be able to cover, as well as looking at the industry’s own carbon footprint.

“Alongside that work is the acceleration towards renewables and finding the right insurance solutions for them.”

Cyber was already high on the list of risks where full cover was moving beyond the scope of the insurance market and that is not going to change, says Faulkner.

“One of the key risk management challenges is going to be about dealing with cyber risks and the use of data. We have insurers looking at stopping writing broad cover for ransomware risks and they are getting increasingly concerned about the growth in privacy claims. They were small in number but are rapidly increasing on both an opt-in and opt-out basis. We have seen many individual claims exceeding £5000 plus so the incentive to pursue them is already there. Claimant costs are a significant concern for insurers, as the costs recovered by law firms can exceed the compensation paid to the individual claimant. Of course, a single data breach can easily affect thousands of individuals so exposures exceeding policy limits are now not as rare as one might have previously thought.”

The conversations about how to respond have already started with several insurance industry initiatives gradually coming together, which is something to be welcomed, says Lord Hunt.

“The solutions lie in creating a trialogue between government, regulator and industry. We must be clear on the allocation of roles as we seek solutions, especially in helping reduce the government’s risk exposure. There is a lot to be said for co-ordinating this through one body and the work that Julian Enoizi is doing with Pool Re is showing the way.”

Vulnerability, equality and financial inclusion

As insurers, government and regulators work together to find collaborative solutions to these risks, issues of social cohesion and consumer vulnerability will be very much to the fore.

These are potentially transformative issues that have frequently been pushed aside before, says Mick McAteer, founder and co-director of the Financial Inclusion Centre (FIC), who urges policymakers and providers not to ignore the lessons of the recent past.

“There is such a wide disparity of experience in the pandemic. Some people have done quite well because they have saved money and reduced expenditure. Others have done very, very badly. You have to remember that it was only on the eve of COVID-19 that average real earnings in this country recovered to pre-2008 crisis levels.”

This analysis is backed up by Financial Conduct Authority (FCA) research which showed that 14% of the working age population were better off in 2020, compared with 28% who saw their financial position worsen. Many of those worse off responded by cancelling insurance policies or suspending pension contributions in order to save money, with as many as 2.9m people doing so according to the FIC.

Often, these are people identified as socially excluded in other ways and falling behind the increasingly digitised world of commerce and day-to-day living.

"The impact of the past year has brought to the forefront just how much we now rely on our digital skills to manage our day to day lives,” says Stephen Noakes, Managing Director, Retail Transformation at Lloyds Bank.

“Digital engagement is increasing across the country, with a significant increase in those who are using the internet, now 95%, up from 92% last year.

"While this is hugely encouraging to see, it's important that we don't lose sight of the other 5% – 2.6 million people – who are still offline which in many cases is exacerbating some of society’s existing vulnerabilities. More needs to be done to tackle this digital divide and help those still locked out post lockdown."

Of those not digitally connected, 39% are under the age of 60 and 55% earn under £20,000, further illustrating how other factors combine to exclude people from financial advice and products.

“COVID-19 is not just having an impact now but is storing up problems in terms of long-term financial resilience,” says McAteer.

He warns of the danger that for all the concern about equality and financial inclusion now, it could be forgotten when it really matters. The FIC has mapped the response and recovery from the pandemic into four phases (see Box). He sees a danger that when the real problems start to hit vulnerable individuals and families, attention will be elsewhere.

“When the forbearance and protection measures are finally removed, as we move into the recovery and rebuilding phase, the lesson from the 2008 financial crisis is that this is often the most dangerous phase for the financially vulnerable.”

Defining vulnerability in a way that makes it a manageable problem still needs more work, says Lord Hunt, concerned that by identifying too large a pool of people it might not be possible to focus on the sort of targeted solutions that will be needed. This is not to dismiss the nature or scale of the challenge, however.

“How is the regulator going to define vulnerable people and deal with financial inclusion? Those will be key questions and we do need the regulator to develop a more targeted view of vulnerability. The FCA has said 27.7m customers are potentially vulnerable. That is far too high a figure. It is wide of the mark and no help in developing effective solutions to real vulnerability. We in the insurance industry have to help them develop a better approach.

“But we must address the issue of inequality as we emerge from the pandemic. We have seen a big shift towards the cashless society as a result of the pandemic and that is one of many areas where the last 18 months have left us needing to rethink many old assumptions but potentially created new problems along the way.”

Resetting the employment dial: improving diversity

As lockdowns swept around most countries, people were sent rushing from offices to work from home. In some countries that advice is still largely in place but everywhere people are asking where the employment dial will reset itself to when we finally shake off the threat of COVID-19.

“We have to expect working from home to become a permanent feature, at least for most people for some of the time. It has given us much more flexibility and we will want to retain an element of that when the restrictions ease,” says David Sales, Master of the Worshipful Company of Insurers and a leading London market aviation broker.

This is a complex issue which connects strongly to the rapidly expanding diversity agenda, as well as to the sustainability of city centres. It is also one on which there sometimes seem to be more opinions and speculation than facts, says Faulkner.

“This last year has been very unusual and it is important that we develop an evidence-based methodology for assessing how it is working out and how it will change as the pandemic recedes.

“Insurers will need to develop new approaches to returning to office work and the balance that will need to be struck with working from home. It will become a key issue in the attraction and retention of talent. It will be about trusting your people and having grown-up conversations.

“If you are too hard on going back to the office, people will leave and look for somewhere offering greater flexibility. At DAC Beachcroft, we’ve attracted people to our business because of the flexibility we are offering.”

With diversity and inclusion a sensitive key focus for the industry, there is another connected solution in prospect for the more imaginative firms, says Faulkner.

“There will be opportunities to improve the diversity of the workforce. Insurers will be more agnostic about location and that will have an impact on talent as it becomes more mobile.”

That opportunity has not been lost on the City of London Corporation which in a recent report, The Square Mile: Future City, highlighted inclusion as one of its top priorities as the City opens up and adjusts to the new patterns of working.

“We celebrate openness, accessibility and diversity in all its forms. But there is still more work to be done. Among the City’s workforce only 37% identify as female. Black and minority ethnic communities are also under-represented. Addressing diversity in the City, from ethnic and gender to socio-economic, is a priority.”

Alongside these opportunities, there are risks and some obvious limitations if the dial is re-set too far in favour of working from home. People relationships are key to the long-term success of insurers, brokers and their clients and that is something that cannot be replicated on endless video calls. There are also drawbacks in terms of developing strong business cultures, training, mentoring and staff support. These fears lie behind the drive by some businesses, especially US banks, to get people back in their offices full-time.

“Potentially, there are downsides. If you are too remote, how do you build the appropriate internal and external networks and develop a distinctive culture for your firm?” asks Faulkner.

Face-to-face business engagement will have to find its place in the new pattern, says Sales.

“The hardest part has been the lack of collaboration and social interaction. I can’t see how you can forge a genuinely close relationship if you are not meeting people. There is that subtle body language that is a key element of the negotiating process and then there are the casual encounters that are so important for creativity and for younger people to build up their contacts and market intelligence.”

A greener world

The City of London report also highlighted how the recovery from the pandemic will be an opportunity to build a more sustainable, greener city and make a significant contribution to the global battle to limit carbon emissions and the damage being done by climate change.

Governments around the world are talking about major investment to build greener infrastructure as one of the core objectives of their economic recovery programmes and are looking to insurance companies and pension funds to contribute billions to that. With a helping hand from regulators on solvency and capital matching rules, this would be something most big firms in the insurance industry would be willing to engage with.

Climate change is casting a darker shadow, however, dragging the industry into the headlines as campaigners identify it as one of the key supports for fossil fuel business, especially coal.

Some major insurers, especially European firms, have made commitments to withdraw from underwriting and investing in fossil fuels. This has not gone far enough or fast enough for the opponents of fossil fuels. They see the forthcoming COP26 conference in Glasgow in November as a major opportunity to hammer more insurance nails in the coffin of the fossil fuel sector. They have powerful allies.

At the Insurance Development Forum Summit in June, António Guterres, Secretary General of the United Nations, made an unequivocal call for insurance of fossil fuels to end – and end soon.

“I encourage the insurance industry to align its portfolios and investments with net-zero by 2050. Your investment should not be contributing to climate pollution but should be directed towards climate solutions. Invest in renewables, low- and zero-carbon transport, and climate resilient infrastructure. Almost 20 insurance companies, as asset owners, have joined the Net-Zero Asset Owner Alliance (the Alliance) that was convened in 2019. The Alliance is the gold standard in terms of setting credible and transparent targets and timelines to back the net-zero pledges that members have made. I encourage more to join these collective efforts and ensure asset owners send a strong signal across the investment chain.

“We need net-zero commitments to cover your underwriting portfolios, and this should include the underwriting of coal and all fossil fuels. COP 26 must signal the end of coal.

“I support the G7 commitment to end all public international support for coal by the end of this year. Your industry needs to follow suit. Friends, as well as mitigation, we must also emphasize adaptation. I have recently been calling for more and better catastrophe-triggered instruments, easier access to flexible finance, and increased support for regional adaptation and financing. I am pleased to see this forum at the forefront.”

Tough talking with little room for manoeuvre.

Public private partnerships, creativity, resilience

If that all sounds rather confrontational, Lord Hunt believes the industry needs to apply its skills in a positive way: “If we are going to develop a greener society with 2050 as the new target for the reduction to net-zero emissions then governments and international agencies must work with the industry.

“It is only with the creativity and ingenuity of the insurance industry that we can hope to reach the 2050 target. Developing resilience will be the key and the insurance industry should be well-equipped to help with that with its risk management skills.”

Wherever you look the insurance industry faces major threats to its stability and its place in modern economies. This is far from an existential threat, however. The solutions to those complex, inter-connected issues still lie in the hands of the industry and its leaders. The answers lie in building strong public-private partnerships, bridging protection gaps and lending the industry’s skills to building a more resilient world.

The pathway to recovery

The Financial Inclusion Centre set out a possible pathway to recovery from the COVID-19 pandemic in its report, Extraordinary Times Need Extraordinary Measures, which highlighted the potential risks for vulnerable and financially excluded consumers.

The crisis will play out in four phases:

Emergency phase

Temporary government and regulatory measures are in place.

Survival phase

Support measures are removed or phased out and households have to survive financially until a sustained economic recovery comes.

Recovery phase

The economy begins to recover – but it will be some time after this that jobs and household finances recover.

Rebuilding and restructuring phase

This covers the challenge of rebuilding and restructuring the economy, financial system and household finances. New reforms are put in place against the risk of future economic shocks and existing public policy crises are dealt with.

The summer of 2021 has seen the UK and most other major economies start to move from the Emergency to the Survival phase, provided vaccination and public health measures are sufficient to suppress any further major waves of COVID-19 infections. This is perhaps further behind in the recovery than many imagine. The recovery phase is unlikely to gather momentum until well into 2022.

Particular thanks are owed to Mick McAteer and the Financial Inclusion Centre for permission to refer to their report: Extraordinary Times Need Extraordinary Measures