"There will be ongoing discussions on understanding the implications of Martyn's Law." So says the Impact Assessment accompanying the Terrorism (Protection of Premises) Bill which was introduced into Parliament on 12 September 2024. This development may have caught some unawares, despite the efforts of Figen Murray, the mother of Martyn Hett (after whom the Bill is named), to keep the proposed legislation in the limelight. While the Bill's main impacts are likely to be on liability, including public liability and D&O, insurers, brokers and insureds will need to consider the detail of the Bill and its impact on coverage and exclusions in existing property and terrorism policies as well. These could be positive (for example, a reduction in premiums where it is recognised that premises represent a better rated risk as a consequence of having public protection procedures in place) or negative (for example, where there have been identified failings). Certainly, where available for enhanced duty premises and events, underwriters should be obtaining the information prepared for the Security Industry Authority as part of the presentation of the risk. Additionally, the greater awareness of the threat of terrorism could result in more property owners applying for terrorism-related insurance policies.

Informed Insurance

Informed Insurance

Scenario planning in 2025 - In the grip of uncertainty

We are now all operating outside the previous boundaries of our experience, buffeted by forces we cannot predict, let alone control or influence. I...

The ESG "backlash": How to balance competing demands

Climate change and social issues have, for (at least) the last decade, occupied legislative, regulatory and shareholder thinking, with implications...

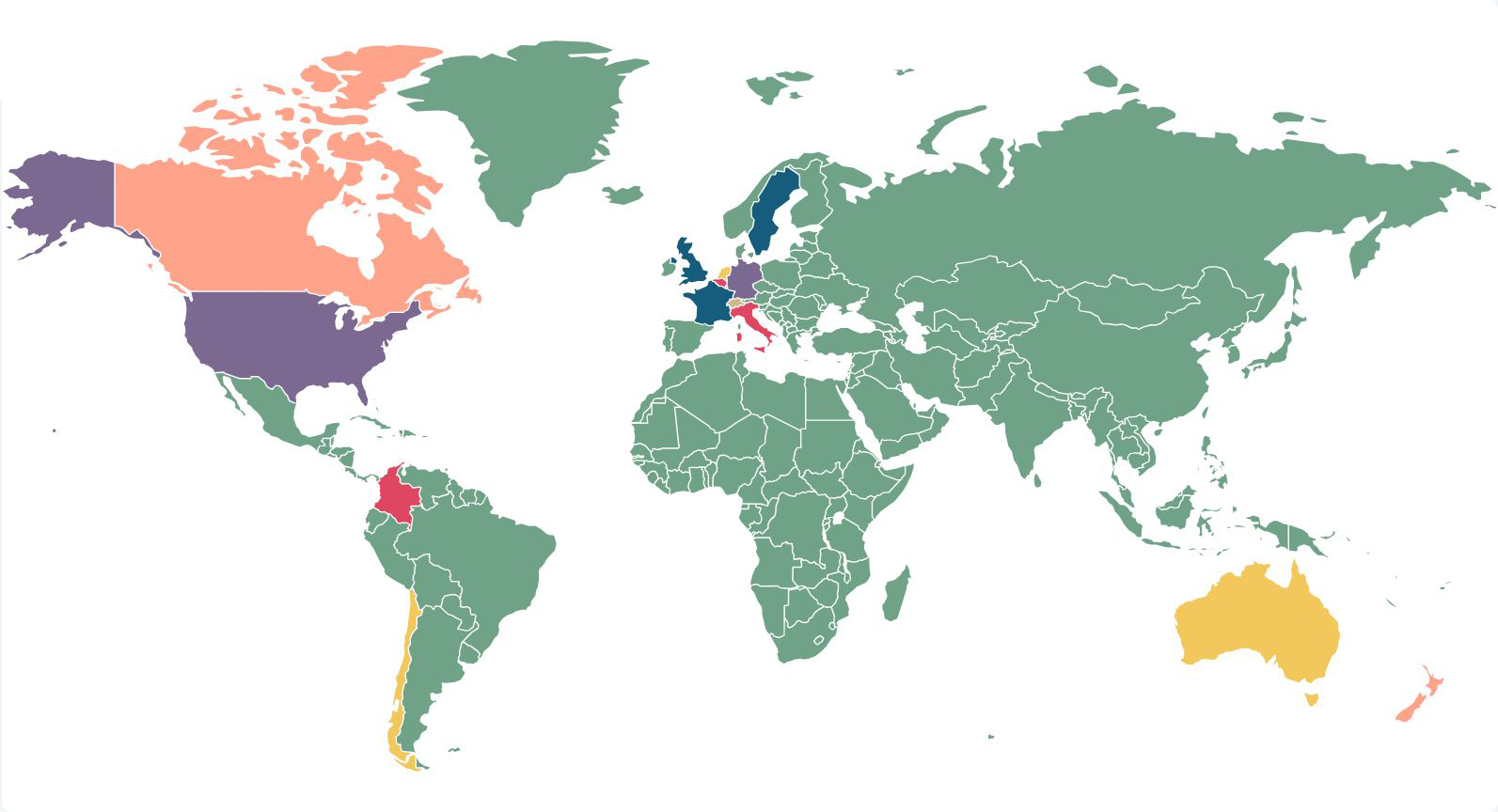

Developments in climate change litigation: 2025 could herald an expansion in types of claim and remedies

To accompany the fourth edition of our interactive climate change litigation map, we take a deeper dive into the implications of the key decisions ...

Our Top Five Economic predictions for 2025

To highlight our new economic theme on Informed Insurance, Charlotte Shakespeare, Legal Director and editor of our Predictions for 2025, shares her...

Our Top Five ESG predictions for 2025

In our ongoing #DACBCrystalBall series, Charlotte Shakespeare, Legal Director and editor of our Predictions for 2025, shares her Top Five ESG predi...

Predictions 2024 – Charlotte Shakespeare's Top Ten

In our ongoing #DACrystalBall series, Charlotte Shakespeare, Legal Director and editor of our Predictions for 2024, once again shares her Top Ten p...